kentucky inheritance tax calculator

Kentucky is a reasonably friendly tax state. Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

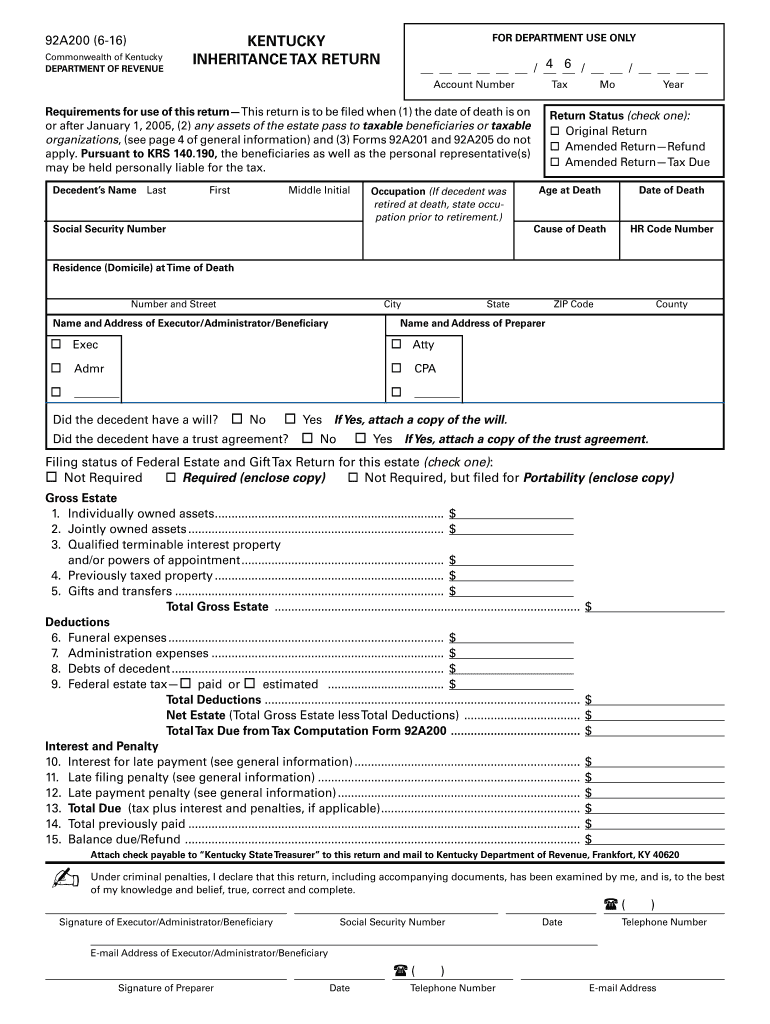

Form 92a200 Fill Out Sign Online Dochub

300 Definitions for KRS 140310 to 140360.

. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6. The Kentucky income tax rate is 5 for all personal income.

The Kentucky State Tax Calculator KYS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. In Kentucky you need to file an inheritance tax return when you receive an inheritance. The value of the inheritance tax is calculated in consideration of the relationship the beneficiary had with the decedent and the value of the inherited property.

How much is the Kentucky inheritance tax. The inheritance tax is not the same as the estate tax. Annual 2019 Tax Burden 75000yr income Income Tax 3750 Sales Tax 4500 Property Tax 645 Total Estimated Tax Burden.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. This calculator can help you calculate your taxes by breaking down your income into taxable and nontaxable components. The range we have provided in the.

Kentucky has three classes of beneficiaries based on how closely related they are. Your household income location filing status and number of personal. These amounts are based on the income tax tables for the state of.

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. The Kentucky inheritance tax is a tax on the right to receive property upon the. To estimate your tax return for 202223 please select the 2022.

Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. Estate and gift taxes the.

There is a different inheritance tax rate for. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Class A beneficiaries pay no taxes on their.

Kentucky has an inheritance tax ranging from 4 to 16 that varies based on.

Death Tax The Truth About Estate Taxes Ramsey

Inheritance Tax 2022 Casaplorer

How To Pay Inheritance Tax With Pictures Wikihow Life

How Much Is Inheritance Tax Probate Advance

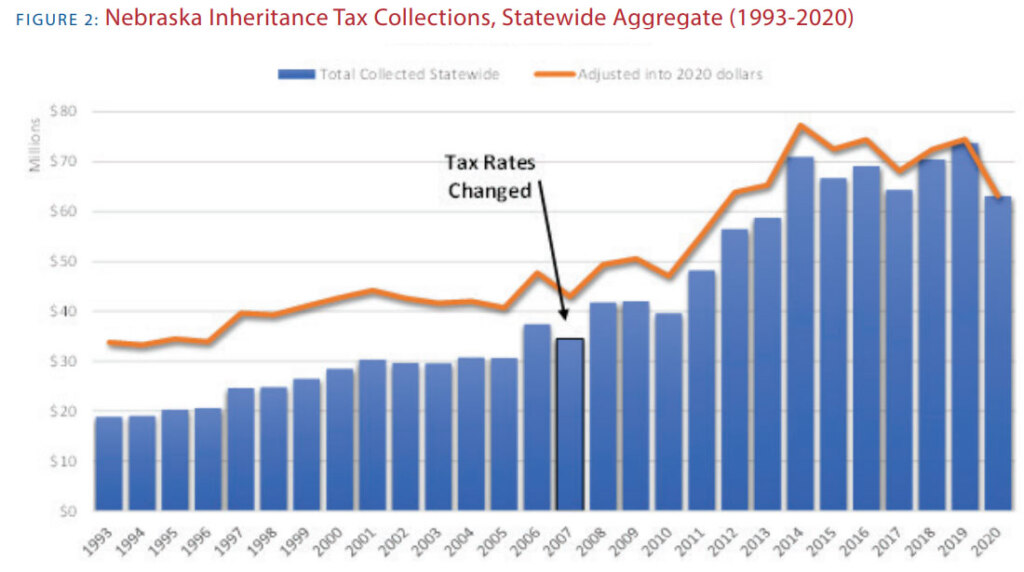

Death And Taxes Nebraska S Inheritance Tax

Estate Planning Keeping More For Your Family Ppt Video Online Download

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How To File The Inventory Tax Credit Department Of Revenue

What S The Difference Between An Estate Tax And An Inheritance Tax Phelps Laclair

How To Calculate Inheritance Tax 12 Steps With Pictures

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Calculate Inheritance Tax 12 Steps With Pictures

Calculating Inheritance Tax Laws Com

Kentucky Income Tax Calculator Smartasset

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

Kentucky Retirement Tax Friendliness Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Four Things You Should Learn About The Kentucky Inheritance Tax Kentucky North Carolina Estate Planning Attorneys